HDB Time line planning for back to back transactions

- Chia Damian

- Jul 9, 2024

- 3 min read

I will touch on the HDB Time line planning for back to back transactions, both using HDB loans and bank loans.

When you are looking for back to back transactions (Sell & Buy), you will need to take note of the financial and the time line aspect. Do take note, as doing a back to back transaction requires precise planning, I will suggest that you:

While you are selling your unit, shortlist 2 to 3 units that you would like to buy (after getting the HFE done)

The moment you gotten an offer that you are happy to accept, offer for the units that you had shortlisted. Once the unit you shortlisted accepted your offer, you can go ahead to accept the offer for your current unit

Why do we want to do the above? During the pandemic, I received many calls from prospects that enquired for my rental units as they managed to sell their units but failed to find a unit they wanted. This created a lot for stress for them and during the pandemic, when the rental market was a boom, it was almost impossible to get a 1 year lease term, not to mention any lease lesser than that.

Therefore, this is a very crucial point to take note of! Another important point to take note of is, the extension of stay. If you need to do renovation to the new unit that you are buying, you will definitely need to have an extension of stay if you do not have any alternate accommodation. How does extension of stay works?

Extension of stay (Max 3 months), is granted by HDB so long as these conditions are met:

Both buyers and sellers agree with the arrangement

Sellers need to have an Exercised Option To Purchase in order for HDB to approve it

Extension of stay will allow sellers to stay on in the unit they sold after the completion and from they, they do a renovation to the new unit, after which, move in to the new unit and handover the current place.

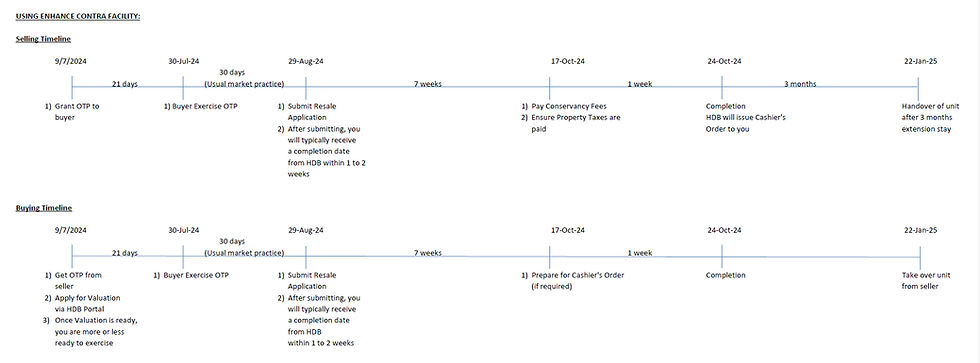

Please find below timeline for your reference. The dates are base on Selling and buying on the same day; which will mean that you will use the Enhance Contra Facility offered by HDB. Using Contra is only possible if you are:

Either on HDB loan for your current property, or you had fully paid up your mortgage for this property

And you are taking HDB loan for the new property purchase or you are not intending to take a loan for the new purchase

Time line for sell and buy (back to back transactions) using HDB Enhance Contra Facility

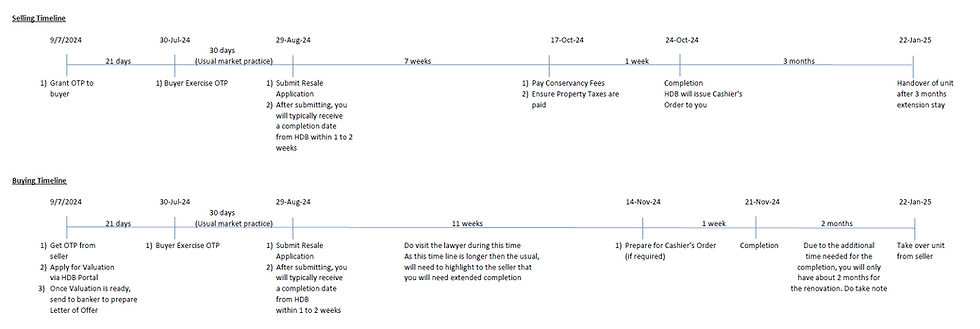

In case you are not on HDB loan and will be taking a bank loan, you will need to take note of the completion dates of the selling and buying. The rule of thumb is, the completion of the sales must be at least 3 weeks away from the completion of the purchase. I personally will advice my client to factor in 4 weeks to be safe. Lets take a look at the below time line.

Time line for sell and buy (back to back transactions) using bank loan

Hope the above illustration will help you with managing the time line for your buy and sell process! I will touch on the financial calculation in my next blog. Stay tune!

Meantime, if you have any questions, do feel free to drop me a note!

Comments